According to the annual foreign direct investment report data, in 2021, China's foreign direct investment flow reached $178.8 billion. Among them, the proportion of non-state-owned enterprises has increased from 40.2% in 2012 to 48.4% in 2021, showing an increase of 8.2%.

In the first half of 2023, the total import and export goods value of China's was 20.1 trillion yuan, a year-on-year increase of 2.1%. Li Xingqian, director of the Foreign Trade Department of the Ministry of Commerce, said that while the scale of foreign trade was generally stable in the first half of the year, the quality of trade continued to improve. The share of emerging markets in imports and exports increased by 1.8 percentage points compared with the same period last year, reaching 63.5%. In addition, the quality of export products has been upgraded, and high-quality, high-tech, and high value-added products have grown strongly.

The Director of the Department of Foreign Trade of the Ministry of Commerce stated, "Recently, we have been conducting tracking research on key foreign trade industries and enterprises and have noticed some positive changes. For example, cross-border exchanges are further improving, and the number of international flights is steadily recovering. The proportion of enterprises with stable or increased new orders is on the rise. In industries with greater pressure, such as electronic information, the import of intermediate goods is on the rise, which also indicates that there may be a turnaround in the second half of the year."

Foreign investment absorption remains stable.

Guo Tingting, Vice Minister of Commerce, mentioned that since 2023, the number of newly established foreign-funded enterprises in China has grown rapidly. In the first half of the year, there were 24,000 newly established foreign-invested enterprises, an increase of 35.7% year-on-year. The actual use of foreign capital amounted to 703.65 billion yuan, a decrease of 2.7% year-on-year.

China has been continuously improving the quality and level of foreign investment cooperation since 2023. In the first half of the year, non-financial foreign direct investment reached 431.61 billion yuan, an increase of 22.7% year-on-year. Cooperation in new areas such as green economy, digital economy, and blue economy continues to expand.

The Director of the Foreign Investment Management Department of the Ministry of Commerce, Zhu Bing, stated that this year, global cross-border investment has slowed down due to the depressing global economy, but China's actual use of foreign investment has remained relatively stable. Meanwhile, executives from multinational company continue to visit China, conducting in-depth inspections of the business environment and seeking new investment and cooperation opportunities.

In recent years, the Chinese government has introduced favorable policies in areas such as finance, infrastructure, logistics, and customs facilitation to encourage the development of outbound businesses by domestic companies. Despite the enthusiasm of Chinese companies for international expansion and the increasing scale of their revenues, most Chinese enterprises are currently in the primary stages.

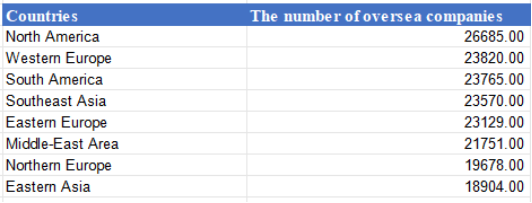

At present, a large majority of oversea companies are in North America, Western Europe, and South America, but they does not have many leading advantages in these three regions. Based on this distribution, Chinese companies' oversea business is gradually spreading from regions such as Europe and the United States to emerging regions such as the Middle East and Africa.

(Data from:Bailian)

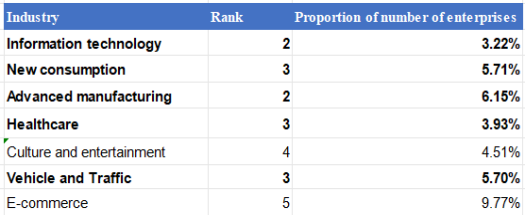

Looking at the regional penetration of industries, information technology, healthcare, advanced manufacturing, and new consumption, the number of enterprises in Southeast Asian have surpassed the number of Western Europe.

(Data from:Bailian)

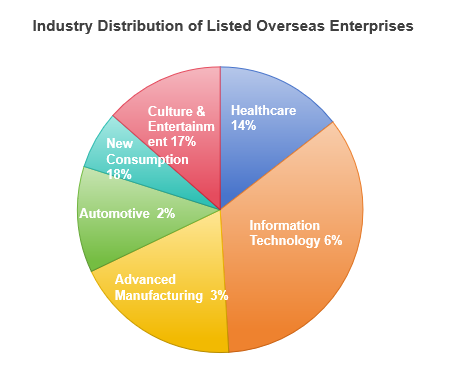

From an overall industry distribution perspective, companies in the information technology, advanced manufacturing, and healthcare sectors show the highest enthusiasm for international expansion.

![]()

Among listed companies, the information technology and advanced manufacturing sectors are more advanced during the stages of international expansion, with a higher proportion of leading enterprises, exceeding 50% in total. There is competition among leading enterprises in various industries such as culture and entertainment, healthcare, automotive transportation, and new consumption.

(Data from:Bailian)

From the analysis of the regional characteristics of going oversea, Southeast Asia is an emerging consumer market with extremely fast economic and technological growth, and there exists a huge potential market. Southeast Asia has a relatively large population, the total population reaching 680 million in 2021. And the population structure is relatively young, and the number of people entering the labor market is continuing to increase.

What’s more, China has always been an important trading partner of ASEAN. Since 2002, the two sides have signed a series of economic cooperation framework agreements, trade agreements, investment agreement to facilitate the foreign trade exchanges between enterprises. With the entry into force of the RCEP agreement in 2022, it aims to eliminate more than 90% of commodity trade tariffs between the contracting parties.

According to the China-ASEAN Comprehensive Economic Cooperation Framework Agreement for Goods Trade, China's overall level of trade liberalization with ASEAN is relatively close, but the situation varies among ASEAN countries. The proportion of zero-tariff goods in Singapore is close to 100%, and Cambodia’s level of trade liberalization is relatively low, with normal product tax items accounting for 90.4%.

The European region is a mature, diversified and highly regulated market. The European government will allocate 30 billion euros from 2021 to 2027 for transportation, energy and digital infrastructure construction to ensure the development in the fields of science, technology and environmental protection. In terms of tariffs, the new EU e-commerce value-added tax regulations implemented in July 2021 will bring additional taxes to the EU government on imported goods. In terms of product safety, products entering the European market need the CE certification.

Countries in South America are all developing countries, and their overall economic development level is slightly behind, and the epidemic has a greater impact on their economic burden. In 2021, the per capita GDP of most countries is lower than average. In the field of IT, the financial technology market is considered to have great potential, attracting more and more foreign investment. Currently, there is a large gap in the regulations and procedures between customs in South American countries. However, in terms of Internet finance, regulatory review in South America is relatively strict, which is beneficial to the development of local Internet financial companies.

The Middle East is one of the regions with the largest young population in the world. At the same time, young people are the fastest growing population in the Middle East and will be able to enjoy a relatively generous demographic dividend in the next 30 years. China is currently the largest trading partner of Arab countries. In the first three quarters of this year, China-Arab trade volume reached US$319.295 billion, a year-on-year increase of 35.28%. Exports to the Arab League accounted for 4%-5% of China's total exports during the same period. In terms of tariffs, the six Gulf countries except Saudi Arabia only charge a 5% tariff on most imported goods; Turkey imposes a 20% tariff on goods imported from China; Egypt stipulates that from October 2021, the consignee of all imported goods must first forecast cargo information in the local system to obtain the ACID number. In addition, Chinese companies need to pay attention to local payment when exporting to Middle East to avoid losses caused by goods being stranded at local ports.

In the post-epidemic era, both large, small and medium-sized enterprises have shown a stronger willingness to go oversea than before. In the process of going oversea, companies often encounter many difficulties due to cultural differences, laws and regulations, and currency exchange rate fluctuations. Therefore, each enterprise needs to understand the laws, regulations and tax systems of different countries and customize services according to the market of each country. Some countries may have erected access barriers and imposed restrictions on the entry for foreign companies. So companies need to understand these barriers and take appropriate steps to overcome them.

Behind these oversea enterprises, Chinese cloud vendors such as Tencent Cloud, Alibaba Cloud, and Huawei Cloud have made early arrangements, established many service areas around the world, and built a large number of CDN acceleration nodes to protect them. The problem they face is the complex network environment brought about by the digital wave, such as DDoS attacks (distributed denial of service), which have become the most common attack method. DDoS attack is to use a large number of malicious requests to occupy the bandwidth resources of the server, so that legitimate users cannot get service responses.

![]()

Although enterprises will inevitably encounter many obstacles and difficulties in the process of going oversea, there are ways to solve the challenges encountered. Such as using external tools to enhance their capabilities, focus more on business development and innovation, or formulate a clear international expansion strategy, including target market selection, market positioning and product localization strategies. Finally, with continuous learning and improvement, companies need to adjust strategies based on experience.

It is believed that , in the future, oversea companies will continue to move towards compliance, process and systematization, and the era of disorderly going oversea will end.

And 527 Supply Chain, one of the companies that going overseas, will still continue to build on our success. We will continue to provide exceptional service to our customers, create sustainable growth, and work hard in an ever-changing business environment. We look forward with confidence to the challenges and opportunities ahead.