1.IDC's Worldwide Quarterly Ethernet Switch Tracker Shows Moderate Declines in 3Q24

Worldwide Ethernet Switch Market Decreased 7.9% Year Over Year (YoY) in Q32024; Router Market declined 17.4%

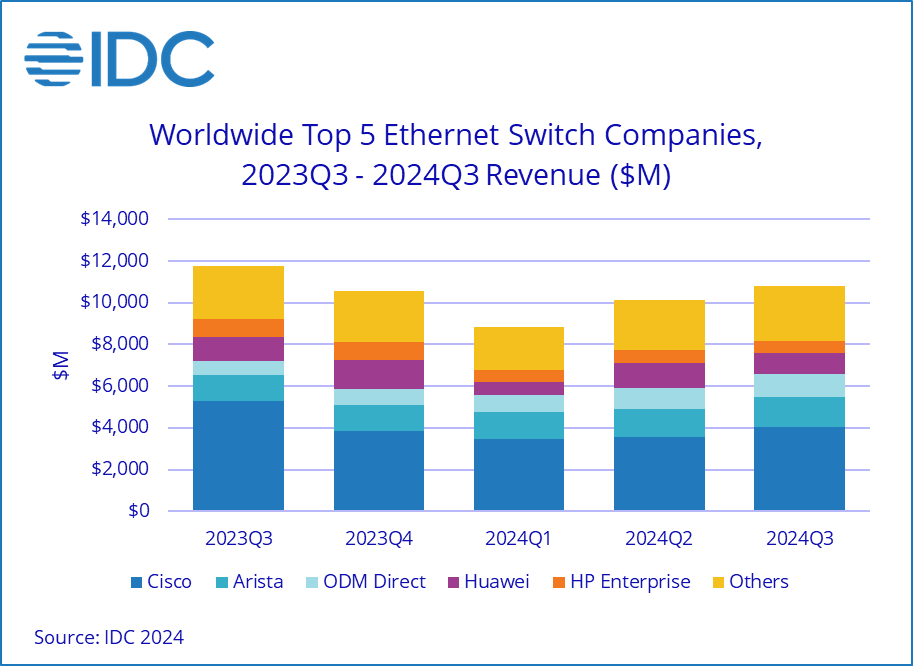

NEEDHAM, Mass., December 12, 2024 – The worldwide Ethernet switch market recorded $10.8 billion in revenue in the third quarter of 2024 (3Q24), a 7.9% year-over-year (YoY) decline. Despite the annual drop, the market grew 6.6% from the second to the third quarters of 2024. The total worldwide enterprise and service provider (SP) router market declined 17.4% y/y to $3.1B in 3Q24. These findings are detailed in the latest editions of the International Data Corporation (IDC) Quarterly Ethernet Switch Tracker and IDC Quarterly Router Tracker.

Ethernet Switch Market Highlights

The Ethernet switch market showed varying trends across the datacenter and non-datacenter segments. Revenues in the datacenter (DC) portion of the market rose 18.0% YoY and rose 6.2% sequentially from 2Q24 to 3Q24. Total market revenues for 200/400 GbE switches rose 126.3% YoY in 3Q24 and rose 23.8% from the second to the third quarter of 2024, indicating strong interest in the highest-speed Ethernet switches. ODM (original device manufacturer) Direct sales continue to be a growing part of the datacenter segment, rising 56.5% YoY, and comprising 19.4% of the datacenter portion of the Ethernet switch revenues.

The non-datacenter (non-DC) segment, primarily used in enterprise campus and branch deployments, declined 24.7% YoY, However, this segment rose 7.0% from the second to the third quarters of 2024. The annualized decline was attributed to challenging comparisons with the quarter from a year earlier, which had historically high revenues driven by product backlog drawdown. 1GbE switch revenue declined 25.6% on an annualized basis but rose 11.5% sequentially.

From a geographic perspective, in the United States, the total Ethernet switch market declined 6.5% YoY but rose 13.0% sequentially. In the US, the datacenter market increased 23.2% YoY while the non-datacenter segment fell 29.3% annually. In Western Europe, the market fell 11.9% YoY but rose 8.1% from 2Q24 to 3Q24. In Central & Eastern Europe the market declined 17.8% annually but rose 9.0% sequentially. In the Asia Pacific region, excluding Japan & China, the market declined 8.7% YoY but rose 4.7% sequentially, while in the People's Republic of China, the market was flat annually with a 4.7% sequential decline

"Ethernet switching is a critically important technology for enterprises, service providers and cloud giants, as connectively demands continue to rise in the cloud and AI era," says Brandon Butler, Senior Research Manager, Enterprise Networks, IDC. "While datacenter growth is fueled by high-bandwidth and low-latency AI workloads, the requirements are driving enterprises and service providers to deploy ever-faster Ethernet switch speeds. In the non-datacenter segment, Ethernet switch vendors are embedding AI capabilities into software management platforms to improve operations and performance, aligning with the market’s transition to more balanced supply-demand dynamics."

Router Market Highlights

The service provider segment of the router market, which includes both communications SPs and cloud SPs, made up 70.8% of the total router market and declined 22.3% YoY and 6.3% sequentially. Revenues in the enterprise segment account for the remaining share of the market and declined 2.4% annually but rose 1.2% sequentially. From a regional perspective, the combined service provider and enterprise router market in the America’s declined 24.8% YoY; the market was off 14.1% YoY in the Asia Pacific region and declined 9.3% YoY in Europe, Middle East & Africa.

Vendor Highlights

Cisco's Ethernet switch revenues declined 24.0% YoY in 3Q24 but rose 13.7% from 2Q24 to 3Q24. Cisco’s total Ethernet switch share stood at 37.2% in 3Q24. Cisco's combined service provider and enterprise router revenue declined 29.7% YoY in 3Q24.

Arista Networks Ethernet switch revenues – 90.4% of which are in the DC segment - increased 18.0% YoY in 3Q24 and rose 7.0% sequentially, giving the company 13.6% market share.

Huawei's Ethernet total switch revenue declined 6.6% YoY in 3Q24, giving the company a market share of 9.7% in the quarter. The company's combined SP and enterprise router revenue declined 13.4% YoY in 3Q24, giving the company 27.0% market share.

HPE's Ethernet switch revenue – 84.6% of which are in the non-DC segment – declined 36.4% YoY, giving the company 5.3% market share.

H3C's Ethernet switch revenue declined 7.1% YoY for a market share of 4.1% to end 3Q24. In the combined service provider and enterprise routing market, H3C's revenues decreased 8.7% YoY, giving the company 2.4% market share.

2. AI Spending in the Middle East, Türkiye, and Africa Set to Soar as Region Commits to an AI-Fueled Digital Future

Dubai – Spending on AI in the Middle East, Türkiye, and Africa (META) totaled $4.5 billion in 2024 and is projected to surge to $14.6 billion by 2028, representing a compound annual growth rate (CAGR) of 34%.That's according to the latest insights from International Data Corporation (IDC), with the global technology research and consulting firm attributing this rapid growth to the region's steadfast commitment to transitioning toward an AI-driven digital economy.

As the META region continues to prioritize AI and generative AI (GenAI) strategies, investments in infrastructure, platforms, foundation models, governance, data architectures, and skills are accelerating. At the same time, organizations across the region are increasingly pivoting from experimentation to scaled adoption and from proof of concept to proof of value.

IDC will explore the challenges and opportunities presented by this shift in priorities as it hosts the META region's most influential technology vendors, telecommunications operators, and IT service providers at IDC Directions META 2025. Taking place on January 28 at the JW Marriott Hotel Marina in Dubai, this exclusive tech industry event will address the theme 'Transitioning Your Customers to an AI-Fueled Future.'

IDC’s latest research highlights the transformative economic impact of AI, with the technology expected to contribute $19.9 trillion to the global economy by 2030 and account for 3.5% of global GDP. Every dollar spent on AI solutions will generate an economic ripple effect of $4.6 through indirect and induced contributions, reinforcing AI's role as a key driver of innovation and productivity.

"Organizations are embracing this transformation, with 89% of worldwide IT leaders projecting stable or increased budgets in 2025 to prioritize AI-led initiatives," says Crawford Del Prete, IDC's global president. "The META region is uniquely positioned to lead the global AI revolution. With the right investments in digital infrastructure and AI governance, organizations across the region can unlock unprecedented economic opportunities and set a global benchmark for innovation."

IDC Directions META 2025 will showcase IDC's latest research and insights into this transformation, offering actionable guidance to help businesses and governments unlock the full potential of AI. "AI adoption has undoubtedly begun transforming the region's business landscape," says Jyoti Lalchandani, IDC's regional managing director for META, Central Asia, and India. "However, the road ahead requires a sustained focus on building robust ecosystems, fostering skills development, and ensuring scalable cloud and datacenter solutions to fuel the next phase of digital growth."

3. Spanish carrier Telefónica has named Marc Murtra as its new executive chair over the weekend. (By Paul Lipscombe)

Murtra will replace José María Álvarez-Pallete, who has held the position since 2016.

According to Telefónica, the move has been carried out as part of the company's new shareholding structure. It follows approval given to Saudi Telecom Company's (STC) to complete its acquisition of a 9.9 percent stake in the carrier in November.

The Financial Times reported that the Spanish government, the largest shareholder in Telefónica, played a pivotal role in the leadership change at the telco.

The Spanish government concluded its purchase of a 10 percent stake in Telefónica following STC's initial announcement in September 2023 that it had agreed to acquire a stake. The government's stake was purchased through the state-holding company Sociedad Estatal de Participaciones Industriales (SEPI).

Álvarez-Pallete, who had spent 26 years at Telefónica, was told on Friday (January 17) that he would be ousted from the company, reports the FT, which noted that the company's board met to agree the decision on the following day.

During his tenure at the carrier, shares dropped by around 50 percent, at a time when many European telcos have struggled. The company also lost its position as the biggest telco in Spain last year, as Orange and MásMóvil completed their merger.

Murtra joins the company from Indra, a defense group that specializes in radar systems. Indra is also part-owned by the Spanish state. Murtra was chair at Indra.

He started his career in the nuclear industry, at British Nuclear Fuels Ltd in the UK before he moved to the Management Consultancy DiamondCluster, where he worked for large technological companies.

The FT added that although STC doesn't currently have a seat on Telefónica’s 15-member board, it's expected to push to fill a current vacancy with one of its candidates.

STC previously said it doesn't intend to push for a majority stake in the Spanish telco, when it first announced it had acquired a stake in Telefónica.

When STC announced its initial agreement to purchase the stake, it prompted the Spanish government to heavily scrutinize the deal as STC would become the biggest shareholder in the company, surpassing BBVA, BlackRock, and CaixaBank.

STC is the biggest mobile operator in Saudi Arabia with 20 million subscribers, and has more than 100 million customers globally, with operations in Bahrain, Kuwait, and Malaysia.

The company is 64 percent owned by the sovereign wealth fund of Saudi Arabia, the Public Investment Fund (PIF).

4. Another 2.5 million sq ft data center campus proposed outside Atlanta, Georgia

By Dan Swinhoe

Via a Development of Regional Impact filing with the Georgia Department of Community Affairs, TPA has filed to develop a data center campus known as the Newton County Technology Park.

The project, set to be located east of SR 11, north of I-20, and west of Social Circle Road outside Social Circle in Newton County, could span nine buildings and 2.56 million sq ft (237,830 sqm) a full build-out.

The first phase of the project could go live by 2031. Further details weren’t shared.

TPA Group is a private real estate investment firm based in Atlanta. The company says it invested acquired, developed, and sold more than 300 sites totaling more than $30 billion in investment across the US – including industrial, residential, office, business parks, and retail sites.

Social Circle is a city in southern Walton and Newton Counties, some 45 miles east of Atlanta.

Meta has a data center just outside Social Circle, while Sailfish Investors recently filed to develop another 1.78 million sq ft (165,365 sqm) data center campus along Social Circle Parkway.